does maine tax retirement pensions

Call us toll free. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

![]()

Opinion New Tax Relief Plan Will Disproportionately Benefit Wealthy Seniors Maine Beacon

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs.

. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. The 10000 must be reduced by all taxable and nontaxable social.

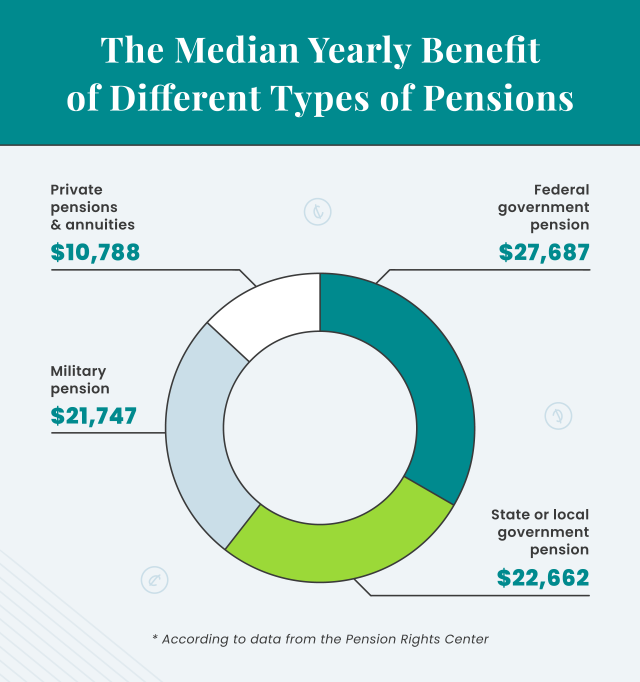

Maine Revenue Services processes the Income Tax Withholding Quarterly Return Form 941ME as well as the Unemployment Contributions Report Form ME UC-1. How Are Teacher Pensions Calculated in Maine. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. June 6 2019 239 AM. When evaluating retirement destinations avoiding the states that do tax federal government pensions could save a federal retiree thousands of dollars in state taxes every.

However that deduction is reduced in an amount equal to your annual Social. Employer Self Service login. Military pensions and Railroad Retirement benefits are fully exempt.

Maine allows for a deduction of up to 10000 per year on pension income. Taxes on Pension Income. On the other hand if you.

The figure below illustrates how a teacher pension is calculated in Maine. MA pensions qualify for the pension exemption. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

If you believe that your refund may be. Maine allows for a deduction for pension income of up to. Maine Tax Breaks for Other Retirement Income.

In addition up to 25000 of other federally-taxed. Pension wealth is derived from a formula. You will have to.

Age 65 or older whose adjusted gross income is 25000 or less for single filers or 50000 or less for married filing jointly. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. The state does not tax Social Security income and it also provides a 10000 deduction for retirement income.

To All MainePERS Retirees. A lack of tax.

Benefit Payment And Tax Information Mainepers

Is Arizona State Retirement Income Taxable

Retirement Asset Division In A Maine Divorce The Maine Divorce Group

Tax Withholding For Pensions And Social Security Sensible Money

7 States That Do Not Tax Retirement Income

Pros And Cons Of Retiring In Maine Cumberland Crossing

Maine Retirement Tax Friendliness Smartasset

How To File Taxes For Free In 2022 Money

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

How Every State Taxes Differently In Retirement Cardinal Guide

States That Don T Tax Social Security

24 States That Don T Tax Retirement Income

Do I Have To Pay Maine Income Tax If I Live In Nh Clj

Tax Withholding For Pensions And Social Security Sensible Money

Average Retirement Income Where Do You Stand

How Will Your Retirement Benefits Be Taxed The Motley Fool

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio

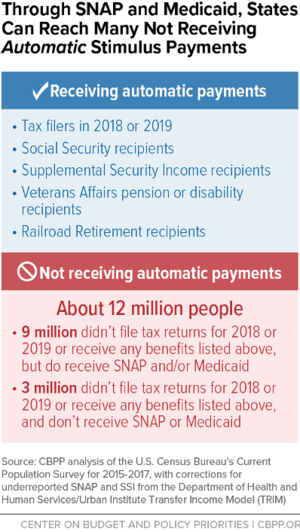

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities